Live In Caregiver Program Room And Board Deduction

Not trying to start a political discussion but these are typically or at least often undocumented workers often middle aged ladies supporting families.

Live in caregiver program room and board deduction. Other factors include if a caregiver will provide a vehicle. En español as a family caregiver you went into the job knowing it would take much of your time. You may not have expected it to take quite so much of your money. If one works as a live in caregiver in exchange for room and board this will obviously offset the cost.

A nanny or elder live in caregiver 4 years ago in miami typically made about 300 for monday through friday. Assume a live in domestic service employee including home care workers receives 6 per hour as well as room and board for which the reasonable cost is 100 per week. There are some families that will even try that with other family caregivers. Federal tax credits and deductions.

Overview of the rules for claiming a dependent in publication 501 dependents standard deduction and filing information for additional information about claiming a dependent and certain exceptions that may apply. You should not have a deduction for room and board. Helping your employee adjust. Weekends off only occasionally walking up at night with a room to themselves.

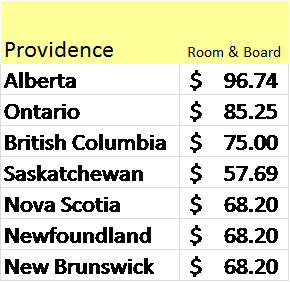

If the employee works 30 hours in a workweek the 180 6 x 30 cash wages is added to the 100 in section 3 m credit for a total of 280 received in the week. An agency live in would cost much more in the area of 10k a month. The average family caregiver spends about 7 000 a year on household medical and other costs related to caring for a loved one. 85 25 week for a private room and board.

The following faqs illustrate some fact patterns involving family member caregivers who are not employees. Only charges for meals eaten by your employee in your home can be deducted from his or her pay. 53 55 week for meals or. Public holidays are days when most workers including live in caregivers can have the day off with pay or receive a premium for working which could be overtime.

One should look to the cost of renting a single room in one s geographic area to get an idea of this part of the compensation. 31 70 week for a private room or. Maximum charges for room and board. Fortunately there is some light at the end of the tax year.

Maximum deductions room and board. Yes if you itemize. For more information visit. In such cases the caregiver must still report the compensation as income of his or her form 1040 or 1040 sr and may be required to pay self employment tax depending on the facts and circumstances.

Deductions from the minimum wage cannot exceed.